Student loan debt is a major problem in the U.S. We wanted to see which states have the most Student Loan debt and why. Why do some states have much higher debt than others, and why does this happen? Here are the states with the most Student Loan Debt and some potential reasons why:

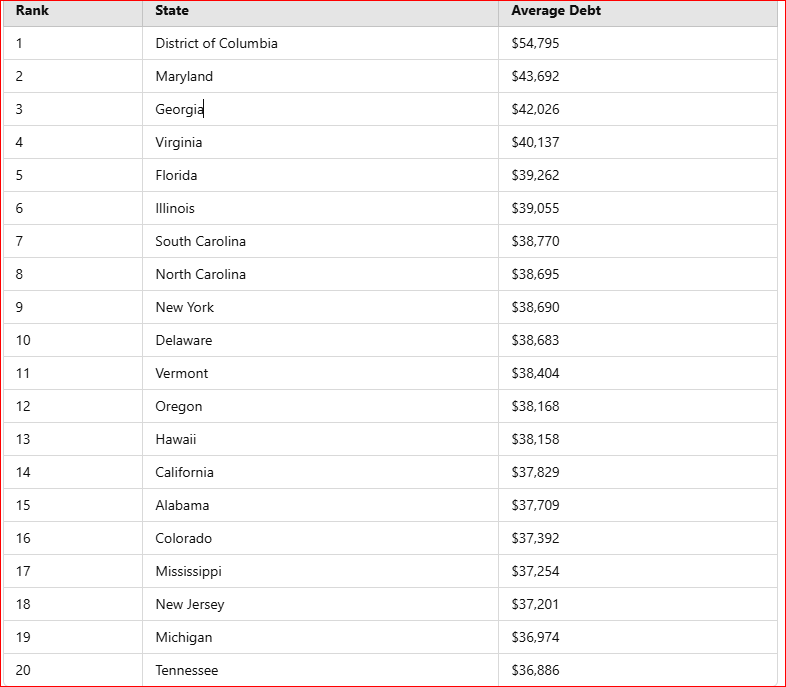

Top 20 States with the Most Student Loan Debt

First, here is a list of the top 20 states with the highest average student loan debt per borrower:

High Cost of Living

How does the cost of living affect student loan debt? One obvious reason is that some states are more expensive to live in than others. Rent, food, groceries, and gas cost more. Tuition prices also go up. Students in these states need bigger loans to cover their school and their expenses. Student loan consolidation or refinancing student loans could help borrowers manage costs in these high-expense states.

For example, Washington, D.C., has one of the highest costs of living and is ranked #1 for average student loan debt. California and New York are also expensive. Even public universities in these states cost more than in others.

More Private Colleges

Private colleges charge much higher tuition than public schools. Many states with high student debt have a lot of private colleges. These schools offer great education but at a high price. Even with scholarships, students often need loans. Forgiving student debt or refinancing student loans could help ease the burden for graduates of these schools.

New York has universities like NYU and Columbia. Washington, D.C., has Georgetown. Georgia has Emory. Tuition at these schools can be over $60,000 a year. That adds up fast.

Large Student Populations

Some states have more students than others. More students mean more loans. Even if the average debt per student is not the highest, the total debt in the state is massive.

California has more than 3 million student loan borrowers. Florida has around 2.7 million. Illinois also has a huge student population. With so many students borrowing money, total debt rises.

Low State Funding

Public universities are cheaper than private ones. However, in some states, public schools do not receive enough funding, which raises tuition prices. Students take out more loans to afford school. Student loan consolidation can sometimes help borrowers manage multiple loans more effectively.

South Carolina and Alabama are good examples. These states spend less on higher education. As a result, students must cover more costs themselves, which means more debt.

Low Wages After Graduation

Graduating is exciting, but in some states, finding a high-paying job is hard. Salaries in these places are lower. Paying off student loans takes longer, and debt grows because of interest. Refinancing student loans may be a good option for those struggling with high interest rates.

Mississippi is a good example. It has one of the highest student debt-to-income ratios. Tennessee and Alabama also struggle with this issue. The cost of education does not match the income students earn after graduation.

These students and parents take out these loans, then get lower wages, and the costs of just living: Groceries, gas, rent, etc. make things so difficult. Let’s not get into the prices of buying a home, that’s a whole other issue!

More Graduate Degrees

In some states, people need extra and higher degrees to get well-paying jobs. This means going to law school, medical school, or business school. These programs add more years and are expensive. Students take out even bigger loans. Student loan consolidation or forgiving student debt could provide relief for these borrowers.

Washington, D.C., is full of lawyers and government workers. Many of them go to graduate school. Maryland and Virginia have many professionals with advanced degrees, which leads to more debt.

Conclusion

Many factors affect student loan debt. High living costs, expensive private schools, and low state funding all play a role. Large student populations and low wages also make a difference. In some states, graduate degrees are required for high-paying jobs. That increases debt even more.

Understanding these reasons can help students make smarter financial decisions. If you are planning for college, consider tuition costs and future salaries. Borrow wisely and look for scholarships and grants. Every dollar saved now makes a big difference later.

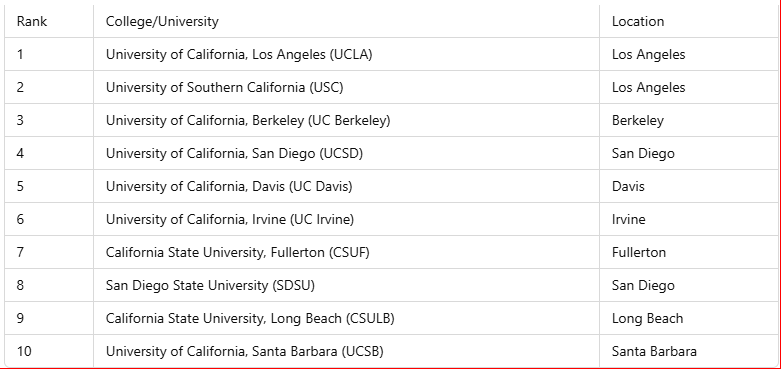

Top 10 Most Popular Colleges in California

If you are curious, because we were, here are the top 10 most popular colleges in California (where we’re located!) based on student enrollment and demand:

These colleges attract the most students due to their strong programs, reputation, and active campus life. Be sure to research financial aid options before making a decision!

Need expert guidance? At Docupop, we specialize in helping borrowers navigate the complexities of student loan payment, consolidation, and refinancing—so you don’t have to do it alone. Contact us today to get personalized support and ensure you’re on the right path to managing student debt.

Don’t wait—take control of your student loans now!

Leave a Reply